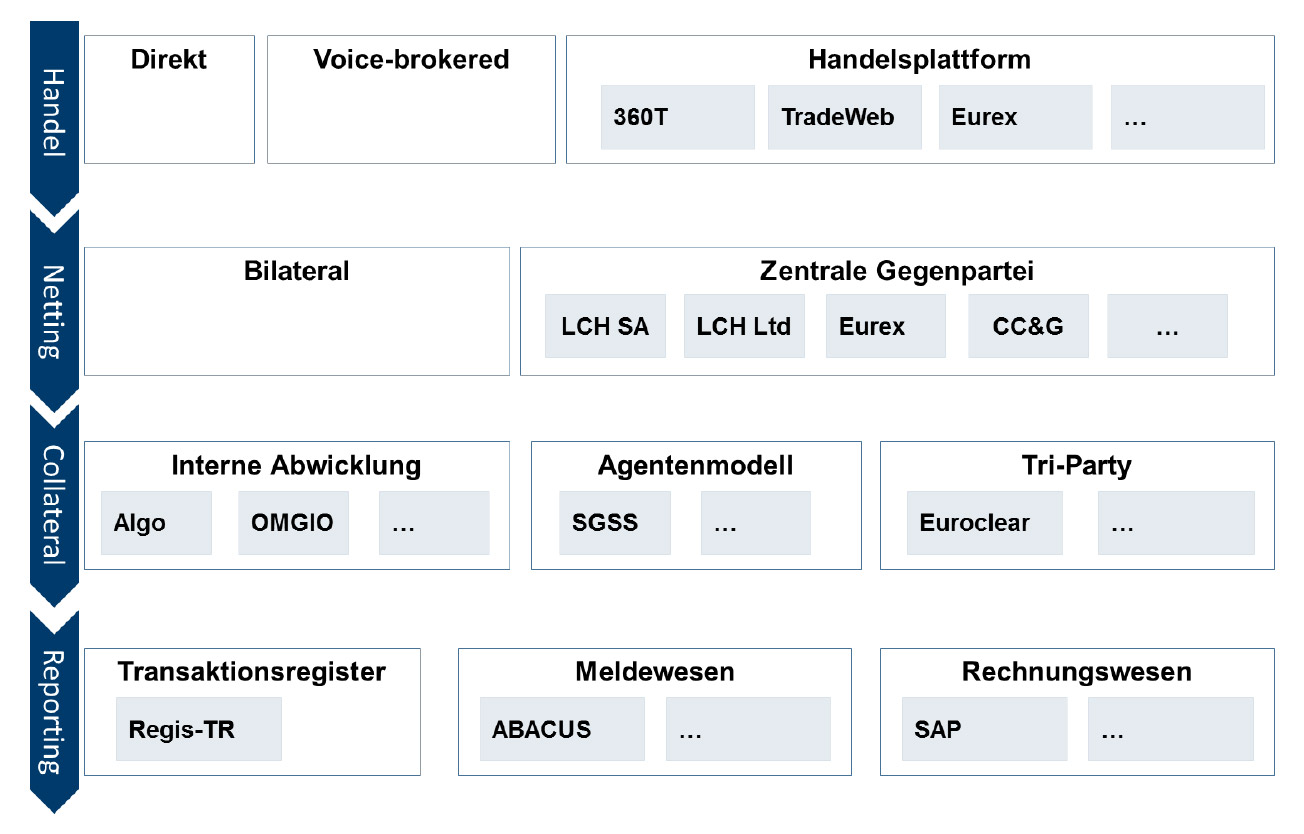

Our strategic expertise is built up by economic analysis and selection processes of service providers in the area of capital market infrastructure (E.g. Trading platforms, clearing broker, central counterparties or collateral agents). We also assisted the introduction of service providers or systems and are used to work at different levels. From the decision makers to the developers, we don’t deliver fragmentary work but finally bring our ideas into production.

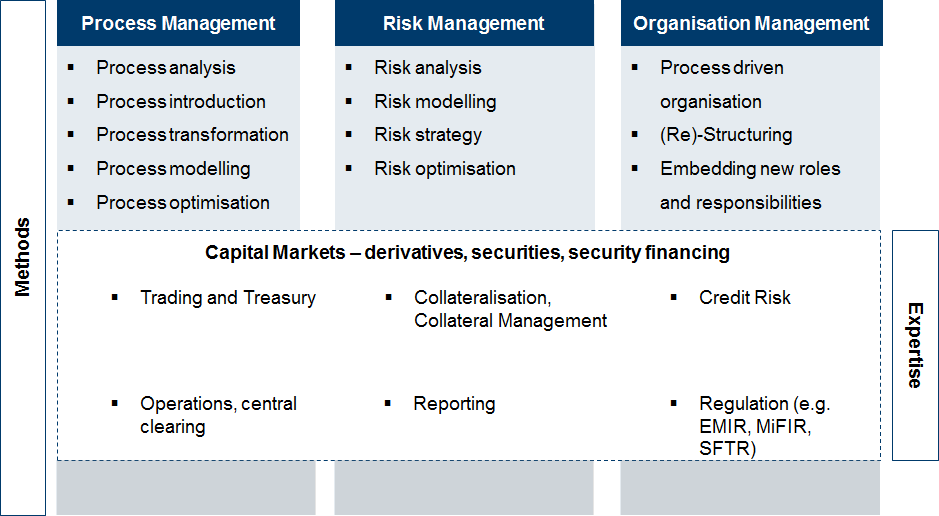

The organisational competences are resulting mostly from projects in which we had to integrate new functions driven by regulation (e.g. introduction of new responsibilities for reporting requirements). Also the adaptation of organizational structures for the introduction of efficient business process management is one of our areas of expertise.

Procedural advice, using modern methods and systems of process management is one of our key areas of competence. The aim is to improve the communication between departments and between departments and IT. We observed such improvements several times and we thus see an offer that can be ideally integrated into projects without additional costs but with additional benefit with respect to communication purposes.

We have experience in the functional and technical specification of requirements. A structured, tabular record of system requirements is essential for a implementation and the tracking of business and functional requirements. Beside that we implement requirements with an ongoing monitoring and cost management, as used in particular at major international companies.